The following guest blog for The Independent Echo comes from Tim Ingham – the Editor & Founder of news and analysis service Music Business Worldwide.

The following guest blog for The Independent Echo comes from Tim Ingham – the Editor & Founder of news and analysis service Music Business Worldwide.

Allow me to begin by apologising for my conceit.

Cards on the table: there’s a load of stuff that goes on in sister entertainment markets that simply cannot apply to music.

You’ll hear a bundle about how Netflix is doing this or that better than Spotify, for example – but few talk about the fact that a rental (or ‘access’) culture has existed in the world of movies for decades, teaching its consumers not to be scared by the idea of never really owning the media they love.

Meanwhile, a subscription pattern has been well-embedded in TV land since 1989, when Rupert Murdoch’s Sky Television first arrived in town.

Then you look at video games: surely a global industry worth $91bn a year – six times that of recorded music – has something to teach us?

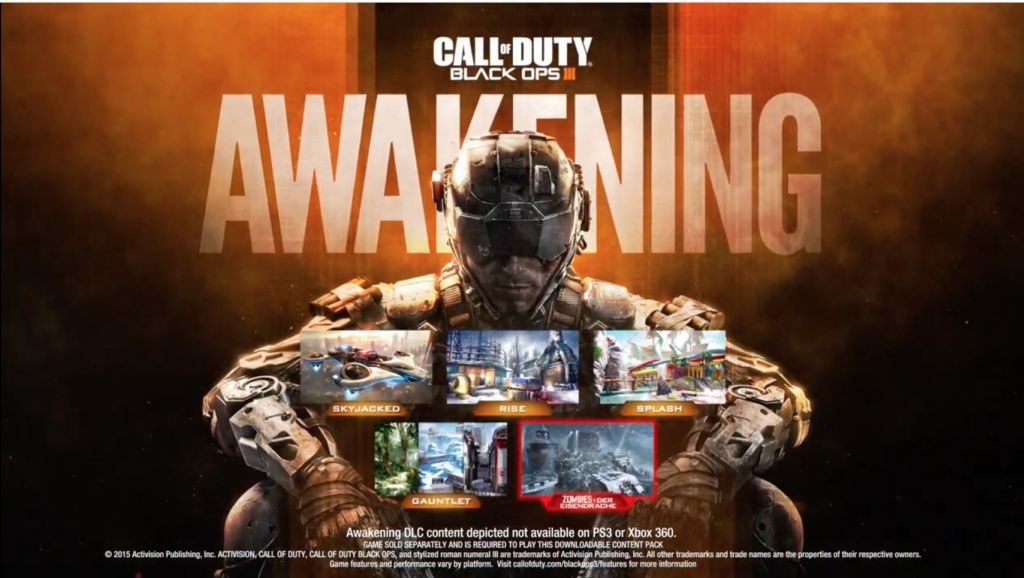

Well, yes. But not before you consider a blockbuster video game like Call Of Duty (pictured) or Grand Theft Auto will cost $200m+ just to develop.

We’ve all heard of labels having to shell out on an artist’s spiraling studio costs, but nothing quite in the same league as these nine-figure price-tags.

What I’m saying is, under that headline above, let’s tread a little lightly.

There are good reasons and long-held conditions which mean the worlds of video games, movies and TV do things a little differently than music folk – and vice-versa.

But I would argue there are also a number of lessons from these markets that independent labels in particular can steal (I mean, ‘take inspiration from’) to enhance their current position.

Some are simple examples that can be pinched today, others are more to do with ambiguous notions of ambition or creativity.

But, I’d argue, they all matter. Here goes…

1) Create a digital marketplace – then sell, sell, sell

1) Create a digital marketplace – then sell, sell, sell

What’s that, you already have a digital marketplace? One that’s been doing pretty well for the indies ever since iTunes pitched up?

I’ll get my coat.

Hang on, though: I’m talking about a B2B digital marketplace for independent produce which, to my mind, still doesn’t exist.

And the reason it doesn’t exist is because the likes of Apple and Spotify are yet to distinguish between ‘independent’ and ‘non-independent’ music – or show any real interest in championing it themselves.

Every spring in the video games industry, all of the notable independent developers head to San Francisco, where they get to showcase their new titles to media (and, crucially, digital platforms) at the Independent Games Festival.

Their aim is to win ‘best in show’ prizes, but also to strike a deal. In particular, PlayStation and Xbox are looking to lay down vast sums of money for windowed exclusive agreements for the next big indie title.

An example: In 2006, US indie game maker Jonathan Blow brought his game, Braid (pictured), to the annual IGF. It was based on very traditional ‘platformer’ style mechanics (Super Mario Bros, Sonic The Hedgehog etc.), but introduced elements of time-manipulation and even philosophical crises into the environment.

It was colourful and kiddy yet brainy and grown-up at the same time.

It was clever. It was ingenious. It was indie.

Microsoft fell head over heels, paying Blow ‘a lot of zeroes’ to lock Braid in as an exclusive on its digital platform Xbox Live. Sony weren’t allowed to touch it for years and, backed by MS’s megabucks marketing, it became a smash hit.

Meanwhile, over in movie land, the same thing is rapidly starting to happen – not at the Independent Games Festival, but at the Sundance Film Festival.

A couple of examples: In January this year, Amazon paid $10m to lock in the exclusive distribution rights to independent film Manchester By The Sea.

Not to be out-done, Netflix paid out $7m for another indie production, road-trip movie The Fundementals Of Caring.

Do you see what is happening here?

Digital monoliths aren’t just buying a little windowed release for their service (as we’ve seen on TIDAL or Apple Music of late in the music biz).

They are sweeping in to the most critically-acclaimed creative sector of their markets – independents! – and paying huge sums to essentially buy completed projects outright.

There’s long been a conversation in music that the likes of Apple and Amazon may start ‘doing A&R’, by investing money to create recordings directly and then exploiting the rights they own.

I can’t see that’s ever going to be worth the hassle. I’d wager Apple and Amazon would much rather talk to independent labels, whose entire business revolves around signing and making exciting new records, to see if they can put their exclusive patronage on these creations.

The big question for labels is this: are you up for taking a cheque from these companies in the early stages of a record, but potentially rescinding the opportunity to accrue royalties from a record for years to come?

As with so much in life, I guess that depends on the size of that cheque…

2) Convince digital platform owners that independent music matters

2) Convince digital platform owners that independent music matters

… which is all hot air, because you don’t really have to worry about all of that right now.

There is no indie music Sundance. No Independent Music Festival.

Right now, music’s digital distribution setup strikes me as very sophisticated vs. movies and video games in one regard – a piracy-beating streaming strategy – but rather backward in another.

The entire reason Microsoft wanted Jonathan Blow’s Braid so badly is because the title was to become the centrepiece of a special channel on its digital platform, called Xbox Live Arcade.

Can you guess what XBLA still specialises in to this day? That’s right: independent games.

Microsoft understands that a certain type of aficionado video game fan would much rather spend money on challenging, leftfield independent creations than lowest-common-denominator Call Of Duty fare. So it’s set up a special curated area just for them.

In doing so, independent games have seen their unique attributes – creative ingenuity, bang for buck, critical acclaim – expounded by the loudest and most respected voices in the video game-playing community.

Indie games have grown because Microsoft has given them special promotion. In turn, they’re getting talked about by tastemakers – and word of mouth is doing what it does best.

This is why Independent Games Festival has become such a huge deal.

Although Netflix and Amazon don’t brand their independent releases to quite such a degree, this pattern is just as apparent on their services. (Just count the amount of independently-produced TV shows and movies being hawked as a ‘Netflix Original’ today).

Where is independent music’s exclusive channel on Spotify or Apple Music?

Where can loud-mouth fans of only the choicest cuts of independent music go to try-out and show off?

This is, broadly speaking, what Edwin Schroter from [PIAS] argued on MBW last year – pointing out that the craft beer industry had undergone a similar branding revolution, based on many of the same principles of ‘independently produced’ goods.

A playlist brand for independent music companies would be a great start.

But, as Xbox Live Arcade shows us, things can go much further than that.

3) Story-fy your releases, or make them episodic

3) Story-fy your releases, or make them episodic

Right. You might take some convincing here.

Clearly, every major TV series of the past ten years, from Breaking Bad to The Walking Dead and Game Of Thrones, has its addictive appeal rooted in the fact that when each episode ends, you’re dying to watch another.

It’s not just a narrative trick, but a release strategy. You remain engaged with these TV brands throughout the duration of a series. By the time each update arrives, you’re desperately ready for it.

Telltale Games made the video games of The Walking Dead back in 2012, and broke with convention to tap into this desire.

Instead of making a traditional 40-hour, high-production licensed title, Telltale instead started releasing short digital ‘episodes’ one-by-one online.

They were a huge hit, with over 30 million episodes now having been downloaded worldwide, at a combined revenue of around $150m.

At the end of each ‘series’, Telltale packaged together the episodes as a single unbroken title and released this too.

This idea hasn’t quite taken off in music. The British band Oh Wonder dipped their toe last year, releasing every track off their upcoming album in stages before issuing the full album at the end of the process.

Although the move was by no means a flop, it didn’t set the world alight.

Whether it’s a release strategy thing, or a creative make-up thing, I reckon there’s something in this ‘episodic’ idea for the album format.

And if you’re still sitting with your arms folded thinking the idea of a narrative album arc could never work, I have three numbers for you.

19, 21, 25.

4) Re-sell to your most loyal consumers within weeks

4) Re-sell to your most loyal consumers within weeks

A simple one, but a goodie.

The latest Call Of Duty made $550m in just three days – 10 times what Jay Z paid for TIDAL.

It’s a staggering amount of money, but greatly helped by the fact that COD costs $60 a pop.

What’s less staggering for the title, Call Of Duty: Black Ops III, is that unit-wise, it sold less than Adele’s 25 in the UK last year. (Back-of-a-napkin maths suggests 25 took around a fifth of COD’s worldwide revenue in 2015, with both titles released in November.)

Yet COD publisher Activision Blizzard also banked a whole load more money in an area where Adele and XL/Beggars could not – or would not.

Downloadable content (DLC) is, as we stand, a goldmine for the video games industry.

As a model, it’s all about re-reaching the franchise’s biggest fans, and drawing extra cash from them while they’re most susceptible to pay it.

After a ‘triple-A’ title like COD is released, DLC will appear within weeks, typically costing $15 – or 1/4 of the original game’s RRP.

This DLC might contain an extra chapter to the story, new guns (sadly… it’s usually guns) or apparel that people can show off with online. It also almost always contains some new ‘maps’, which allow people to play against each other in different environments.

Releasing Adele’s ’25-and-a-bit’ extra ‘pack’ in time for Christmas 2015 may have been a bit too crass and grasping for Beggars to contemplate. I get that.

But that doesn’t mean it wouldn’t have made some serious coin.

5) Consider the price of what you do, and what people will pay

5) Consider the price of what you do, and what people will pay

Here’s a depressing little stat: in 2015, the value of the digital music industry in the UK grew to £1.085bn.

Just three years before, in 2012, it stood at £443m, according to data from the Entertainment Retailers Association/BPI.

This astonishing growth has really all come from on-demand streaming services and, within that category, predominantly come from Netflix.

(The other big contributors are Amazon Prime plus iTunes movie downloads.)

That £1.085bn sum overtook the retail income of the entire UK recorded music market last year, which stood at £1.059bn.

The good news for labels is that for the past five years, music’s annual UK revenues have steadily remained above £1bn.

But you have to question why Netflix, which boasts 71m paying subs worldwide, is transforming its market so dramatically in comparison to Spotify, which has around 29m subs worldwide.

There are myriad differences, not least Netflix’s one-month trial, its lack of exposure to YouTube and an audience expectation of not getting access to every movie ever released.

But one difference we should at least debate is the price. Because Netflix runs an intriguing tiered monthly payment structure in the UK (and elsewhere):

- £5.99 a month to watch one screen at a time in standard definition

- £7.49 a month to watch two screens simultaneously in HD

- £8.99 a month to watch up to four screens at a time, in HD or ultra-HD

There is a clear tempting entry level there of £5.99 – almost half the price of a monthly Spotify or Deezer subscription.

Yet the ability for Netflix to upsell into higher pricing tiers as customers enjoy the service is plentiful.

Music’s services have no road left to run here, and perhaps they should. Perhaps independent music could play a key role in that upsell.

Any tweak in the pricing of streaming music services, especially a tweak downwards, obviously has to be handled with caution. God knows music’s been devalued enough in the past decade without the industry voluntarily shaving its income for no good reason.

But the fact remains that to hit a mass-market streaming audience and yet maximise the revenue per user, the music biz don’t appear to have the formula right just yet.

As analyst Mark Mulligan smartly puts it, with a restrictive binary price structure of free-or-£9.99, we seem to be giving consumers the option of buying a Lexus… or taking the bus.